To build better batteries, knowing how to build phones helps

Battery factories need precision, speed and modularity

Can you think of what high-value manufacturing sectors are still present in the UK, US or Europe?

You will probably guess at automotive and aerospace, and some of you might stretch to defense, satellite technology and pharmaceuticals. In addition, as investment from the ‘Chips Act’ comes online, semiconductor fab will soon join this list in the US.

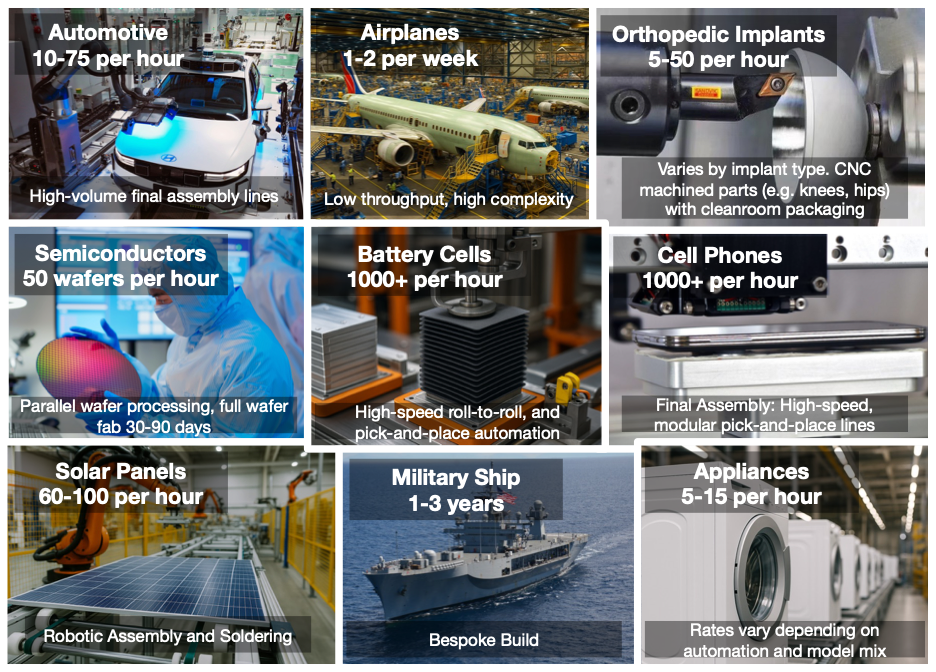

Analyzing the production rates of these industries, they range from 75 jobs per hour for high volume automotive, all the way down to one job every few years for some defense projects, like ships.

Typical single production line capacity of different industries.

These volumes are fine for the products that they produce, but there is a problem, we now want to get good at making batteries whose throughput is measured in thousands of jobs per hour from a single production line.

Skills from automotive or clean energy tech that need to be adapted to incorporate batteries within their production lines or supply chain don’t easily transfer. Stacking of electrodes, electrode insertion, filling, sealing, degassing, placing cells into modules, laser welding hundreds of cells to a busbar, all require a different sort of automation.

What critical industry is China, Korea and Japan so strong that allowed them to transfer over to become world leaders in manufacturing batteries?

Well, if you have never built consumer electronics at scale, you’ll struggle to make batteries.

📉 What was Lost

Until recently, there has not been much desire to rejuvenate a domestic consumer electronics sector in the West. But in the late 1990s, the UK did harbor ambitions to develop homegrown manufacturing, like our ambitions today to bring gigafactories online.

Wales was the hub of this development with Sony and LG investing in new factories and producing televisions under their own brands, as well as products like iMac under contract for Apple.

However, a factory does not make an ecosystem, and many components had to be imported, also the lack of skilled manufacturing engineers meant that Welsh plants could not keep up with their sister plants in Asia implementing automation, solving quality issues and developing local supply chains.

Indeed, as Patrick McGee’s book ‘Apple in China’ highlights, the Welsh iMac assembly line reportedly became known as the ‘toaster line’ for its tendency to burst into flames.

And so, one by one, the factories disappeared, with LG withdrawing in 2003 followed by Sony a few years later, limiting South Wales options in transitioning to alternative industries with the closure of its coal mines.

Even burgeoning local companies such as Dyson, with a more vested interest to make British manufacturing work, found the UK’s supply base too fragmented and planning laws too onerous to bring new capacity online effectively.

Without an ear in government that truly understood the requirements of industry, Dyson moved manufacturing to Malaysia in 2002.

🚀 How Asia moved on

In the intervening 25 years since the UK and US could say that it was competitive with Asia in the manufacture of TVs and Laptops. The sector has moved on with the development of smartphones, wearables and tablets, which the West simply has minimal experience in manufacturing.

An increasing consumer base, development of new products and disruption of existing ones, has seen the value of the market increase five-fold since 2000, to $1 trillion.

TVs have transformed from 130 million Cathode Ray Tubes in 2000, to 250 million flatscreen devices today, while smartphones have gone from a standing start to annual sales of 1.5 billion units.

In that time, consumer tastes have become more demanding, as well as the entrants of new competitors, has meant companies needed to scale, automate and invest in quality all over a short period to remain competitive producing ever more complex devices.

Vast industrial complexes were built, containing 30 or more buildings each with ten floors that contained a mind-boggling amount of production capacity.

These facilities became specialized at going from sketch to prototype, and then from prototype to hundreds of thousands of devices per week, all within a 12-month period.

Typical consumer electronics production site.

📘 What was the Playbook?

It starts with designers sitting side-by-side with manufacturing engineers and contract manufacturers figuring out how to make one perfect unit. Every detail is scrutinized, surface finish, tolerances, cleanliness, even the repeatability of the inspection method.

As each process step is defined, the ‘machine that makes the machine’ is developed. Examples include, developing the CNC program to machine a laptop housing, along with the fixture and tooling to go with it, qualifying it and then rolling it out to the hundreds of other CNCs that are situated on the factory floor.

Alternatively, it may require developing a whole new automated line consisting of several stations linked together with linear XY stages or robots to transfer parts between stations. Each of these stations is specialized to do one assembly operation.

These stations may also integrate (a) devices to perform electrical or leak tests, (b) laser line sensors to perform in-process metrology of critical dimensions, or (c) leverage machine learning in combination with a vision sensor to reject defective parts from the line before further value is added to them.

What is common about both CNC and modular pick and place systems is how quickly they can be reconfigured. CNC programs can be updated, requalified and rolled out. Automated machines can be copied to increase scale, their stations reconfigured, and fixtures swapped out to manufacture product variations or updated designs.

Billions of dollars have been poured into building skill and capacity, with machines capable of producing parts with micron-level accuracy. They can be repurposed quickly to spread the efficiency of the cap-ex investment over multiple product generations.

Automation has reduced the quantity of people you see on the factory floor. Even Quality Control, one of the last places you still see rows upon rows of people inspecting the product before shipment, is being replaced by in-process vision inspection.

Modular automated consumer electronic assembly cell (DWFritz).

🔋 Applying the Playbook to Batteries

Production lines for batteries, particularly cell and module assembly, mirror those developed for consumer electronics. Stations are linked by robotic handlers, linear stages or conveyors. Each dedicated to a specific task such as welding, bonding, testing, cleaning, etc.

Processes are tightly controlled and validated with a level of detail not seen in other areas of automotive assembly. For example, after plasma cleaning of cell terminals, vision systems inspect for micron-sized dust particles which, if present, could affect contact between the cell and the busbar.

Testing is continuous throughout the supply chain and in-house production. Terminal cleanliness is inspected at both cell casing assembly and prior to laser welding within the module line. If particles are found, cells are re-routed to be cleaned again or removed from the production line.

The concept of modularity has also transferred across, with whole stations being able to be removed or added, fixtures swapped out and robots being able to be reprogrammed to use a new custom end-effector. When a design change is introduced, updates can be batched as part of an agile process and introduced to the line.

The tooling, the line design, the reconfiguration strategy is all part of the manufacturing innovation which needs to constantly evolve to keep up with the pace of technology change within the batteries themselves.

🚗 Going Forward

Asia is way ahead in terms of its ability to manufacture current generation lithium-ion batteries, be it China’s dominance in LFP or Korea’s and Japan’s edge in NMC. Therefore, it makes sense for automakers to partner with the giants be it CATL, LG-Chem, Panasonic or Samsung.

However, there is a whole raft of innovations coming down the pipeline, such as lithium-metal solid-state cells or nanoscale silicon anode cells, which promise greater energy density and faster charge speeds.

There are startups around the globe trying to get ahead in this race, to do so means that a whole host of new companies are going to have to adapt the battery manufacturing playbook to their own designs.

Simply trying to outsource to the main players without significant collaboration won’t work because of how linked design and manufacturing is. Too many start-ups die in “manufacturing purgatory” where scaling-up hits hurdles, yields fail to improve and as a result firms come to the end of their funding runway.

As Dr. Halle Cheeseman states:

“Even excellent technologies can’t survive the manufacturing purgatory stateside. By the time they launch, the market’s moved on.”

Whether we are trying to build our own gigafactories or scale new chemistries, consumer electronics manufacturing thinking needs to be applied to battery manufacturing.

We have a lot to learn, and it takes time to master high-speed automation, in-process inspection, rapid DFM cycles, modular production lines and tooling that can accommodate design iterations.

But you must start somewhere, and we are starting.

Thanks for Reading!

- Glen from WattFactory